Official end of the fiscal year. 1 July 2024. The Australian Taxation Office begins to process tax returns from the fiscal year just ended.. GET YOURS TODAY. 14 July 2024. At the end of each financial year employers must lodge a Pay As You Go (PAYG) withholding annual report for all payments not reported through Single Touch Payroll (STP.. The financial year is a 12-month time period used for tax purposes.. June 30, 2024. This marks the end of the financial year in Australia..

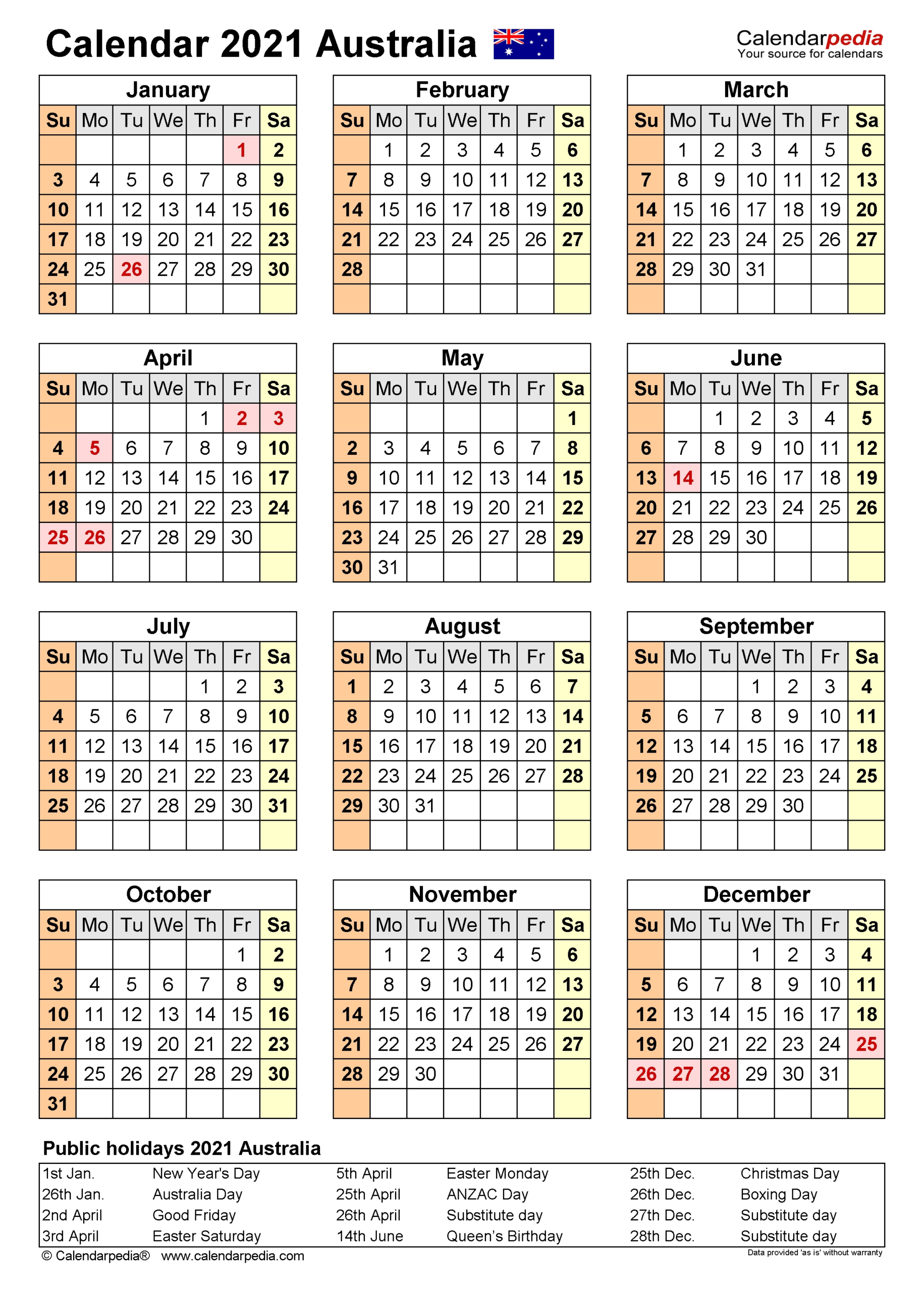

Financial Year In Australia Template Calendar Design

Text sign showing End Of Financial Year. Conceptual photo Taxes time accounting June database

End of financial year hires stock photography and images Alamy

Maximise End of Financial Year Tax Refund Islamic Relief Australia

End of Financial Year Cruise Sydney Harbour Exclusive Sydney Harbour Exclusive

Understanding the Australian economy An introduction to macroeconomic and financial policies

The end of the financial year is coming! Burns Sieber

Australia's financial future and you

Excel How to get Australian Financial Year from dates in Excel YouTube

Election 2022 Australians are obsessed with googling ‘inflation’

Text Sign Showing End of Financial Year. Conceptual Photo Revise and Edit Accounting Sheets from

Australia A Coming Financial Crisis? YouTube

5 money saving tips you can use before & after the financial year end. InCred

Australian Financial Year Update 202021 Immigration Consultants

It's that time again... End of Financial Year! HiRUM

End of Fiscal Year Party End of Financial Year Party Etsy Australia Party, How to make

Fiscal Year Meaning, Difference With Assessment Year, Benefits, And More Glossary by Tickertape

What are the tax dates in Australia Sleek Australia

Happy Financial Year Ending!!! Financial year end, Financial, Happy march

End of Australian Financial Year Giving Australian Mercy

Finalisation declaration for payments to your employees due. Learn about end-of-year finalisation through Single Touch Payroll (STP) on the Australian Taxation Office (ATO) website. 14 July: Pay as you go (PAYG) withholding payment summaries for your employees due. This is only for payments not reported through STP. 28 July. The end of the financial year in Australia is 30 June. The date upon which you are required to submit your tax return depends on the type of business that you operate. Here's everything you need to know: Sole traders and self-employed - Must lodge an individual tax return from 1 July to 31 October. Partnership - Must lodge a partnership.