720.319.8954 True Resolve Tax Professionals: we discuss the simple "How to File" an IRS Offer in Compromise From 656 and form 433-A OIC. We do not discuss th.. The California Department of Tax and Fee Administration (CDTFA) April 1 issued a publication detailing the Offer in Compromise Program. The publication includes: 1) information on what an offer in compromise is; 2) taxpayers who may make the offer; 3) how to apply for the program; and 4) other relevant information on the program. [Cal. Dep't.

IRS Form 656L Fill Out, Sign Online and Download Fillable PDF Templateroller

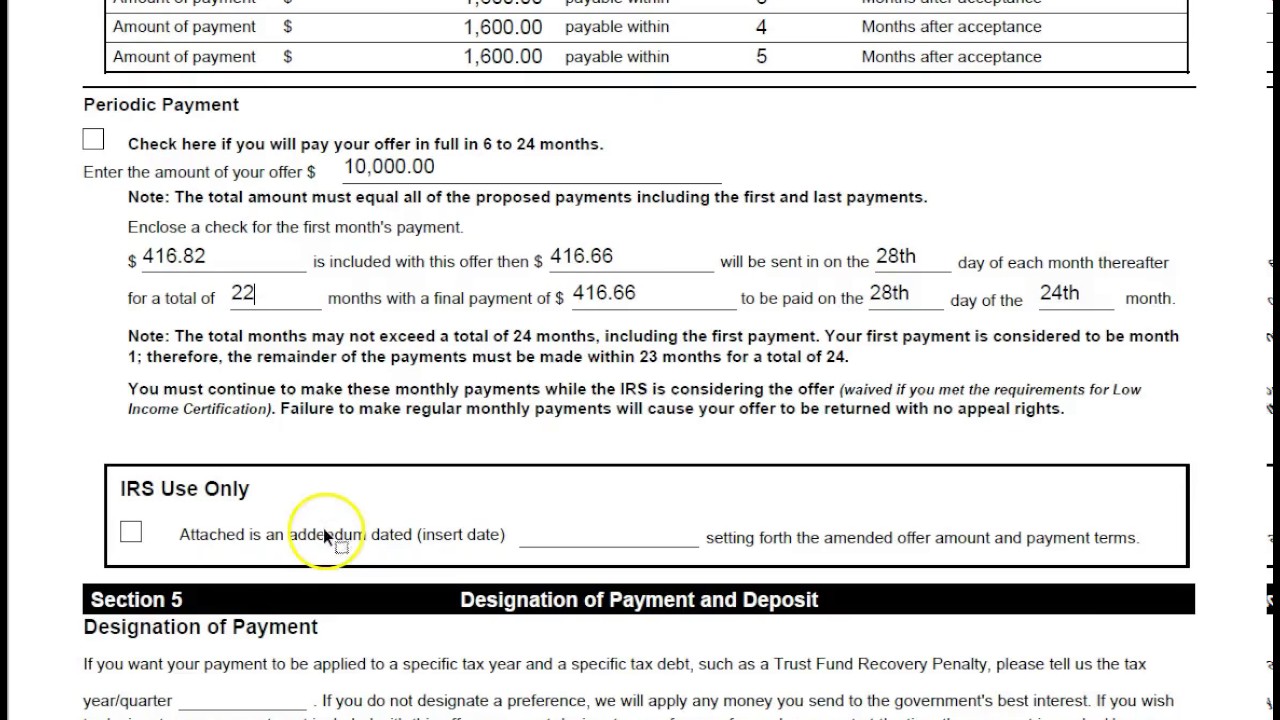

How to Complete IRS Form 656 Offer in Compromise (Reference to 2018 update) YouTube

IRS Offer in Compromise What to Know Credit Karma

![IRS Offer in Compromise [INFOGRAPHIC] 3 Reasons To Not Pay Taxes IRS Offer in Compromise [INFOGRAPHIC] 3 Reasons To Not Pay Taxes](https://help.taxreliefcenter.org/wp-content/uploads/2019/05/20190513-Tax-Relief-Center-Pay-Off-Less-Tax-Debt-.jpg)

IRS Offer in Compromise [INFOGRAPHIC] 3 Reasons To Not Pay Taxes

Offer In Compromise IRS Form 656 YouTube

How To Get An Offer In Compromise From The IRS Detailed Instructions YouTube

IRS Offer in Compromise Example YouTube

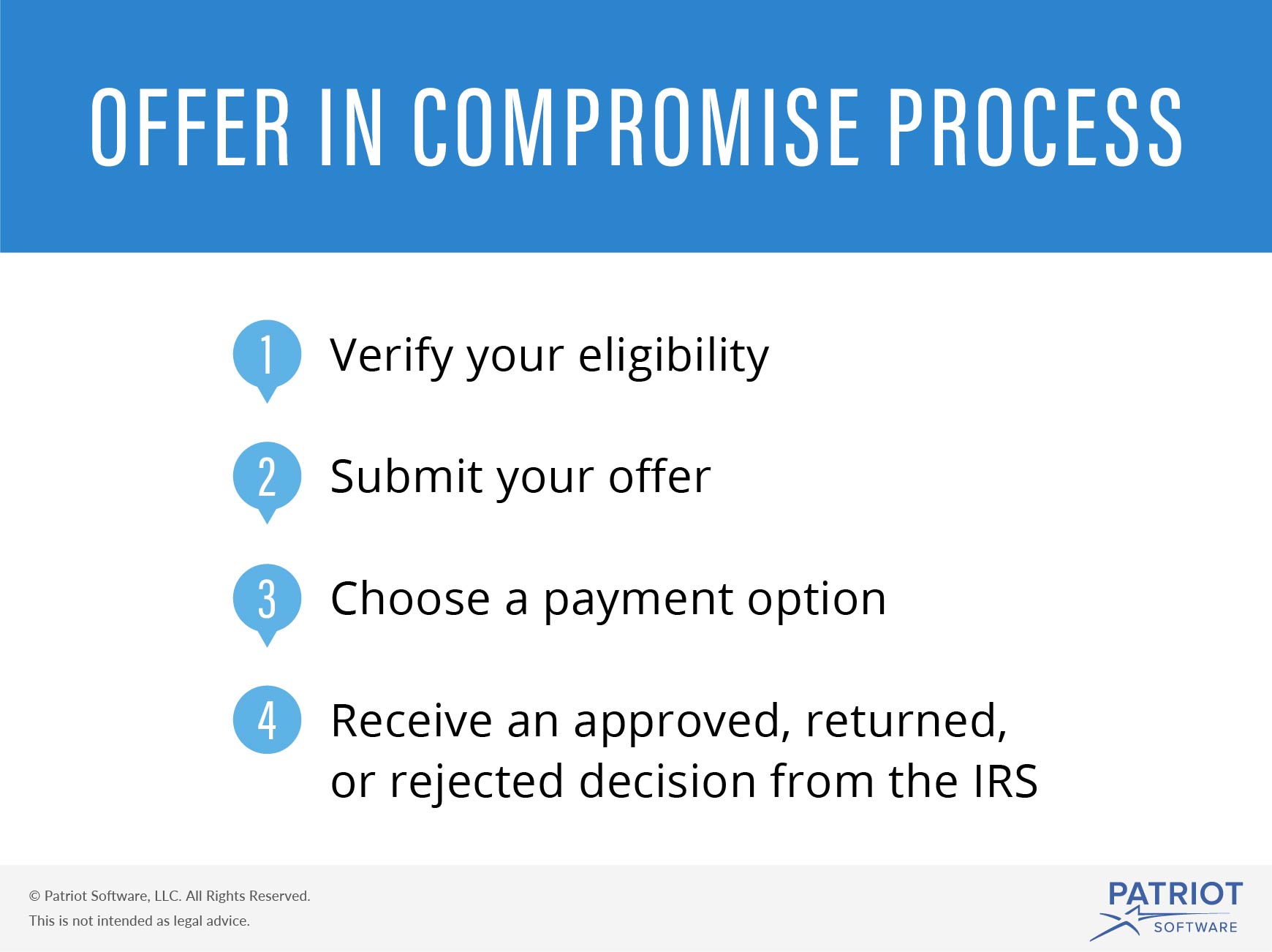

Offer in Compromise How This IRS Tax Settlement Program Works Bench Accounting

How Do I File My Offer In Compromise With The IRS? YouTube

![IRS Offer in Compromise [INFOGRAPHIC] 3 Reasons To Not Pay Taxes IRS Offer in Compromise [INFOGRAPHIC] 3 Reasons To Not Pay Taxes](https://help.taxreliefcenter.org/wp-content/uploads/2019/05/TRC-PIN-IRS-Offer-In-Compromise-_-What-Is-It-And-How-Can-It-Help-You.png)

IRS Offer in Compromise [INFOGRAPHIC] 3 Reasons To Not Pay Taxes

Can't Pay Your Tax Debt? Consider an Offer in Compromise

Are You Considering The IRS Offer in Compromise Program To Settle Your Tax Debt? Tax Attorney

How Often Does IRS Accept Offer in Compromise?

Know These Top 3 Tips for Acceptance of Your IRS Offer in Compromise Delia Law Tax Attorneys

Other Types of Offers in Compromise OMNI TAX HELP

How Long Does Offer in Compromise Take? My Tax Settlement

IRSMedic Offer in Compromise Answers to Most Common Questions

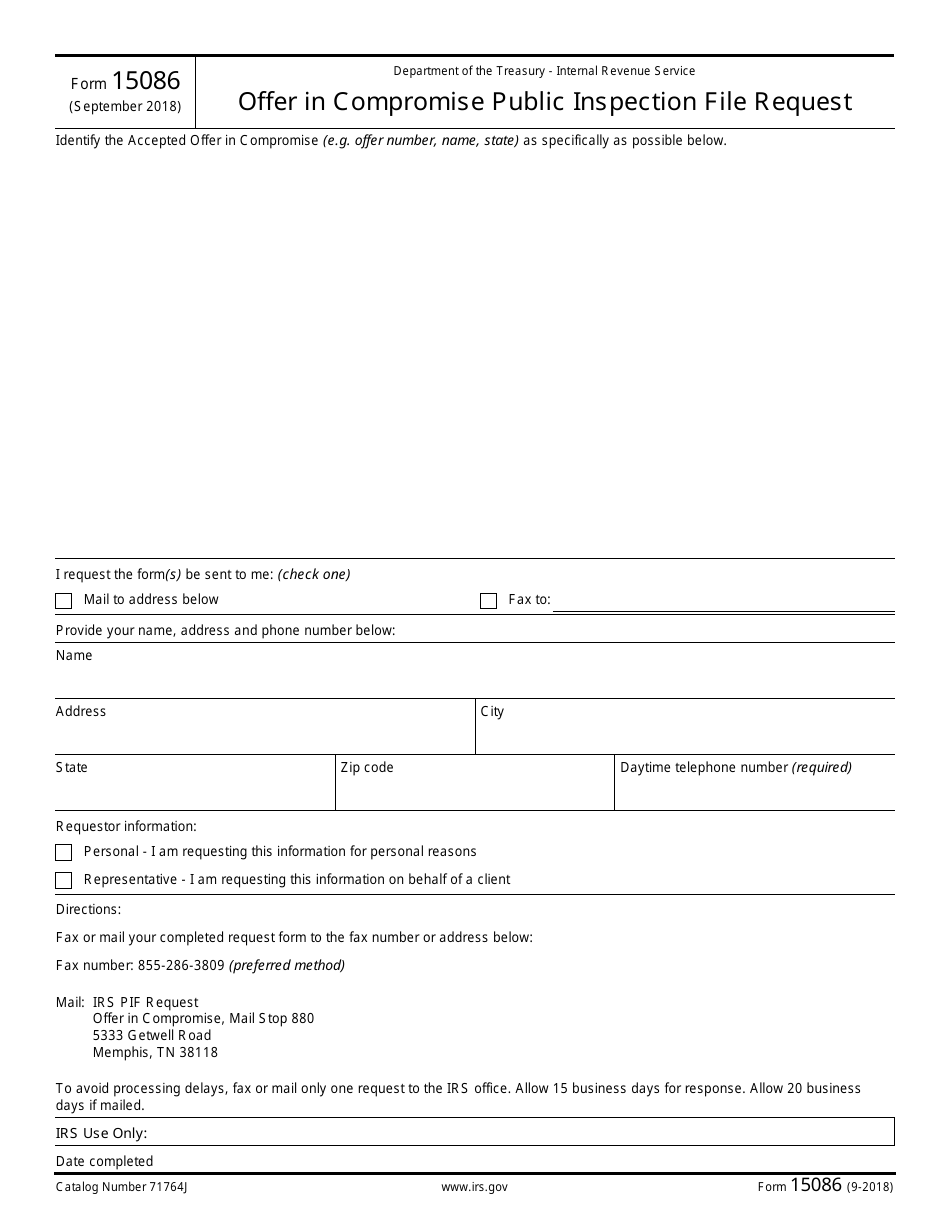

IRS Form 15086 Fill Out, Sign Online and Download Fillable PDF Templateroller

The Truth Behind the IRS Offer In Compromise YouTube

3 Collection Alternatives To Solve IRS Tax Debt Problem

Key Takeaway: Getting an Offer in Compromise approved is like unlocking a secret level in a game. You need to play by the IRS's rules, showing them your financial cards—assets, income, and true expenses—to find out if you qualify for that tax relief win. An accurate 'financial X-ray' or Reasonable Collection Potential is crucial.. A Step by Step Guide to Completing an IRS Offer in Compromise 22 The IRS allows for an additional $200 per vehicle to be added to the Vehicle Operating Costs if the vehicle is over eight years old or has a mileage of 100,000 or more.. you can formally appeal the rejection administratively. This appeal is filed by filing IRS Form 13711 and.